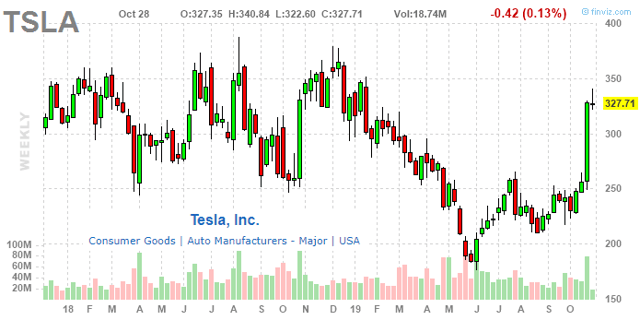

Tesla (NASDAQ:TSLA) reported Q3 earnings with a combination of a surprising EPS beat along with positive comments by management that was enough to send the stock soaring. One of the points we're tracking is the short interest in TSLA last reported at 21% of shares outstanding, representing a notional value of $9.3 billion prior to the earnings report. By this measure, short sellers have lost $2.6 billion as the stock surged nearly 30% over two days from the report with a big part of that move likely based on the classic short squeeze setup with TSLA bears covering. We think that this dynamic may already have run its course and shares now have more limited upside as questions related to long-term profitability and the stock's valuation reemerge. This article recaps the latest earnings release and our view on where TSLA is headed next.

(source: FinViz.com)

How The Market Got the Q3 EPS Number So Wrong

One of the aspects that makes TSLA unique among large-cap stocks is the constant flow of headline-making developments that often times have significant consequence. Whether it's a new car model development, quarterly deliveries update, regional demand trends, the Chinese Gigafactory construction, or even the occasional car-fire video, the outcome is that it's difficult to forecast next quarter's earnings and much less the operational outlook for a year ahead. The point is that there's a lot of moving parts here and we won't blame Street analysts for missing the mark on the Tesla's EPS figure this quarter. Indeed, from a consensus expectation for a negative GAAP diluted loss at $1.31 per share, the profit of $0.78 is the very definition of an earnings beat. CEO Elon Musk summed it nicely in the conference call remarks when he said:

Q3 was obviously a very strong quarter and we had record deliveries, we're able to make great strides and controlling our costs. We shifted back to GAAP profitability while also generating strong free cash flow.

We'd argue that "very strong" is subjective but acknowledge the other points of record deliveries and cost control as true. Regardless, it was enough to bring back a renewed bullish sentiment in the stock that's up 85% from the lows of the year and now just 15% from its all-time high at $385 setback in September of 2017.

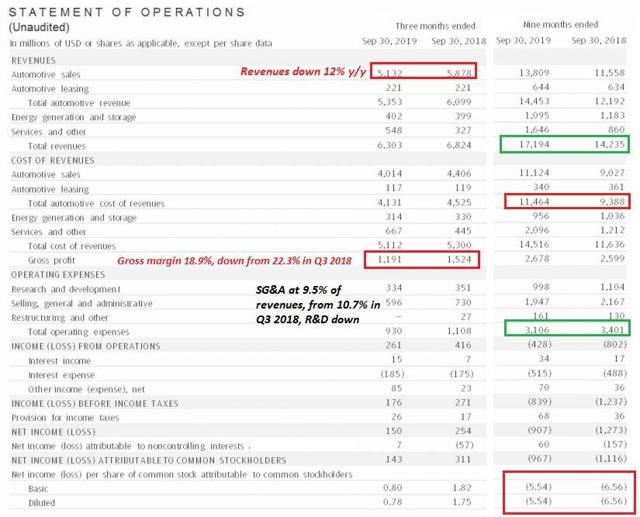

Our take is that the results this quarter was a mixed bag. Revenues actually declined by 12% year over year, while it's still up 19.5% year to date, a respectable figure but hardly impressive among high-growth stocks in the market. Even Amazon.com (AMZN) just reported quarterly revenue growth of 24% and the stock sold off. For Tesla, the story was the company's ability to put together a coherent narrative with a positive outlook.

(source: Company IR)

(source: Company IR)

Yes, there was an earnings beat, but this was the worst kind of earnings beat as it was based simply on inventory timing and cost control. The gross margin in the quarter fell to 18.9% from 22.3% last year. Favorably, Tesla was able to hold down S&A and R&D which both declined compared to last year. Looking ahead, considering the expectations of ramping production, we find it unlikely these figures can remain at current levels. Even as the GAAP income reached $0.78 per share this quarter, year to date TSLA has still lost $5.54.

The Short Squeeze

The set up here post the earnings release for Tesla was one where the stock jumped after hours initially on the headline number and gained momentum through the conference call. Investors got a number of positive nuggets with an overall optimistic outlook by the management team. The following points were discussed that really set the tone for the next day's trading action where shares continued to rally. CFO Zachary Kirkhorn discussed the following items during the conference call:

- Gigafactory Shanghai starting trial production, upcoming announcement of European location by the year end.

- Higher sequential production of Model S, Model X, and Model 3 "enabling better fixed cost absorption."

- Higher average selling prices for Model S and Model X, flat in North America.

- Model Y "ahead of schedule" and moving launch to summer of 2020 from the fall.

- Version 10 and "Smart Summon," video streaming game and karaoke!

- Global order rate remains "strong and continues to increase," growing order backlog.

"In the immediate term, we're focused on increasing production of Model 3 and Model S and Model X as quickly as we can. The bulk of this work involves continued optimization of existing equipment. We've also made targeted adjustments to pricing to better balance supply and demand. Our pace of execution on these factories and capacity expansion has increased significantly."

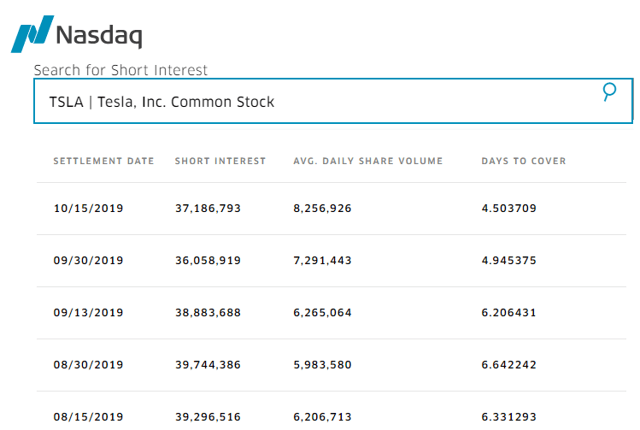

Most of the points here are what we'd call soft data in contrast to hard numbers or targets. Nevertheless, this wasn't the narrative to be short against at $250 and likely forced a number of bears to proverbially "throw in the towel," at least move on for now. According to data from Nasdaq, short interest in TSLA this year peaked back in May at 43.7 million shares, representing 24.5% of shares outstanding and has trended lower to a still significant 20.76% as of Oct. 15, with the most recent data. It's likely this number will trend lower at the next update for Oct. 31, although the report won't be available until later into November. We expect the short interest to remain above 15% of shares outstanding which was the low for the year back in January.

(source: NASDAQ)

Breaking down the short interest numbers, it's possible that there's a significant number of long-term fundamental Tesla bears that simply closed the position in retreat during this rally but will look to reenter at a higher level. Our view is that there are enough long-term uncertainties and valuation concerns that the latest report failed to shoot down.

Essentially, the report was fine for this period, but the results don't go far enough to completely invalidate the bearish thesis. Tesla's performance in Q3 doesn't warrant a runaway breakout to new highs. We expect the short interest to tick lower in the coming months, but the core long-term concerns remain intact and shares will likely remain volatile.

The Bearish Case for TSLA

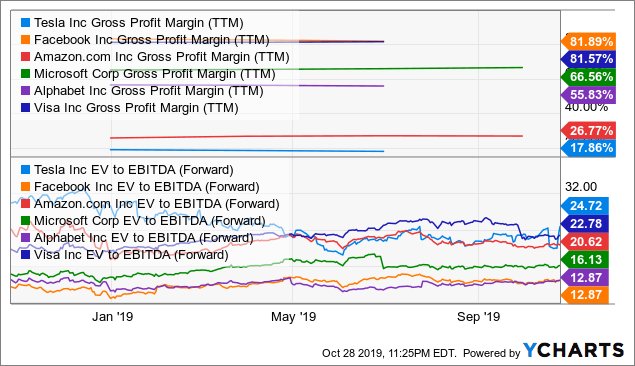

The core of the argument for the bearish case really comes down to valuation. Why should TSLA trade at a premium to some of the leading tech-sector stocks when its core business is in auto manufacturing which has structurally lower margins? For context, we highlight that Tesla's gross margin at 18.9% in Q3 is well below the levels tech companies are achieving. In terms of enterprise value to forward EBITDA estimates, TSLA at 24.7x is more expensive and well above a group that includes Facebook (FB), Amazon, Microsoft (MSFT), Alphabet (GOOGL)(GOOG), and (V).

Data by YCharts

Data by YChartsIn terms of margins, it's difficult to sell a car at ~$50k and hope to consistently achieve a gross margin much beyond the current level Tesla reported for "automobile margin" at 22.8% in Q3. Ford Motor Co (F) for example has averaged a gross margin of about 15% over the past decade. Upside for Tesla stock will require margins to trend higher for the company to grow into its present valuation. We find it unlikely.

As Tesla's growth will be based more on the lower priced Model 3, the trend in the product mix will pressure margins lower. Ideally, for Tesla everyone would be ordering a max-spec Model S which presumably has the highest margins, but the market is gravitating toward the entry level Model 3. The following points highlight what are deeply rooted bearish concerns for TSLA.

- Valuation concerns, market cap at $58 Billion, 60x 2020 consensus earnings, estimate risks tilted to the downside.

- Structurally limited automotive sector margins.

- Model 3 demand may be at a rate that will be difficult to sustain over the necessary product lifecycle.

- Downside to Model S and Model X sales estimates as Model 3 cannibalization takes hold.

- Model S has an outdated design from 2012 with only small exterior updates and will need a major revamp representing significant investments. Expect higher capex and lower free cash flow going forward.

- Model Y could underperform expectations and end up as an unnecessary addition to the lineup.

- Battery supply constraints, lithium pricing risks, pressuring margins long term.

- Supercharger network investments / maintenance requirements.

- Saturated key markets including Scandinavia region/ parts of North America. Tesla will depend on more marginal markets for growth that adds costs and risks.

- Competition catching up. Other car manufactures expanding EV lineup with recent example of the Porsche Taycan in the high-end market.

Conclusion

The market is generally efficient but for Tesla this quarter the combination of a surprise profit coupled with positive comments by management and a high short interest in the stock led to what we describe as a massive short squeeze. We think that the earnings release, while pushing aside some of the most depressive scenarios, was still not strong enough to invalidate the long-term bearish thesis for Tesla. Risks for the company has tilted to the downside. Tesla will need more than perfect execution to justify the current valuation.

We think following a 30% rally post earnings, upside is limited from current levels with the bulk of the new information already priced in. Monitoring points going forward include production and delivery updates, along with trends in the average selling price of the Model 3. We look for shares to remain volatile and see the $300 price as an important support level in play over the coming months, representing about 10% downside as our near-term price target. Long term, a series of weaker than expected deliveries data and/or disappointing weak Q4 earnings will be required for a more material move lower in the stock price.

Disclosure: I am/we are short TSLA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Short exposure via puts