Today, the economy houses several matured markets. These markets have a sustainable demand but do not see significant growth or innovation any longer. Take the printer market, for example. It witnesses slow growth but has a steady demand.

A dominant player in the printer market is HP or the Hewlett-Packard company. This company owns 42% of the global market share and has been ruling this market for over 20 years. The printing division alone earned the company a revenue of 17.64 billion U.S. dollars in 2020, making it one of its most important business segments.

All these characteristics that HP’s printing division show essentially point towards it being a cash cow.

But what is a cash cow?

Let us find out!

What is a Cash Cow?

A cash cow is a business division or product with a significant market share in a mature market that guarantees substantially high returns on investment.

In simple terms, these offerings belong to markets that see less growth but have a substantial market share that generates enough revenue to support the company’s other business activities.

For example, Kellogg’s Corn Flakes has found for itself a centre spot in the cereal industry, making it the market leader of a mature market. The money generated from this division is high enough to support other innovations by the company.

Importance of Cash Cow

Cash cows are known to be a company’s most valuable and competitive product or business divisions as they contribute to a significant chunk of a firm’s operating profits. These profits are a result of low investment and high revenue gains from such products.

The profit generated by these offerings is more than what is required to maintain the business. Hence, these profits are used to finance other activities carried out by the firm.

A firm could use the profits generated by a cash cow for the following:

- Funding research and development

- Investing in other products manufactured by the firm

- Bear administrative costs of the firm

- Pay dividends to the shareholders of the firm

- Reduce the debt burden of the firm

- Grow its market share

Thus, by this means, a cash cow enables a firm to flourish, making it an essential element to the firm.

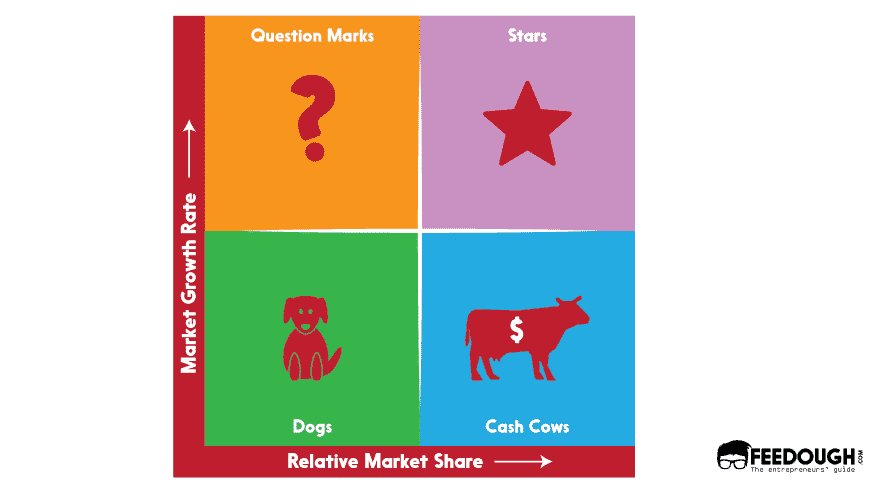

Cash Cow in BCG matrix

The concept of cash cows was first propagated by a model developed by the Boston Consulting Group. The model was the BCG matrix, and firms still use it to planning long-term product strategies.

A BCG matrix divides the product portfolio into four types and assigns cash cows a spot wherein the growth rate is low, and the relative market share is high.

Hence, to be a cash-cow, a product or division should have the following characteristics:

- Low market growth rate: These products belong to a sluggish market, meaning the market growth for the concerned product is essentially slow. Firms are required to consider replacing them, as they belong to a market that is slowly witnessing a downward trend in its growth rate. Just like how a cow is milked, these products are “milked” as the firm refuses to invest too much in a product that belongs to a market with low growth rate.

- High market share: A cash cow product is considered a product that is well-established in the market. These products are typically manufactured by brands that people have have grown to trust over several years.

Examples of Cash Cows

Below listed are a few examples of cash cows:

Apple’s iPhone, iPad and iMac

The Apple products bring in most of Apple’s overall revenue. The iPhone accounts for 61.65% of its revenue, while the iPad and iMacs account for 8.39% and 11.27% of Apple’s total revenue respectively.

All three of these products belong to a market that witnesses slow growth.

The aforementioned products have made a mark on their respective industries, and hence hold a big chunk of the market share in these industries. It can, therefore, be deduced that these products are cash cows for Apple Inc.

Microsoft’s personal computing (Windows)

Microsoft has been the dominant player in personal computing after it released Windows in 1983.

Today, Windows accounts for only a small part of Microsoft’s business, while it generates a steady revenue for the company.

Hence, Windows is a cash cow for Microsoft.

Printing division of HP

HP’s printing division has dominated the market for about 20 years.

It’s printing division has brought the company substantial revenues. Thus, it is no doubt that the printing division has been HP’s greatest profit generator over the years, making it the company’s cash cow.

Strategies that Aid Cash Cow Products

A cash cow is integral to a firm as it allows the firm to finance its operations. Hence, the firm needs to adopt strategies to aid the firm milk promised profits from such offerings. Some of these strategies have been listed below:

- Marketing the product: Some cash cows don’t require a lot of marketing since they are well-established. However, if it’s not the case, firms should spend enough on the sales and promotion of such offerings.

- Creating a budget: It is almost impossible for a product to sustain itself, and so, a firm is required to set out a budget to make the product still relevant in the market. This would require the firm to keep a check on the market demand of its cash cow and gather feedback to make amends if required.

- Prioritising the cash cow: A cash cow generates the largest profits without the firm having to invest much. Most firms aim for larger profits, and hence, maximising its sales should be prioritised.

- Product development: Product development in the case of cash cows refers to improvising the already existing product to make it relevant in the market.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think about our article in the comments section.

A startup enthusiast who enjoys reading about successful entrepreneurs and writing about topics that involve the study of different markets.