wellesenterprises

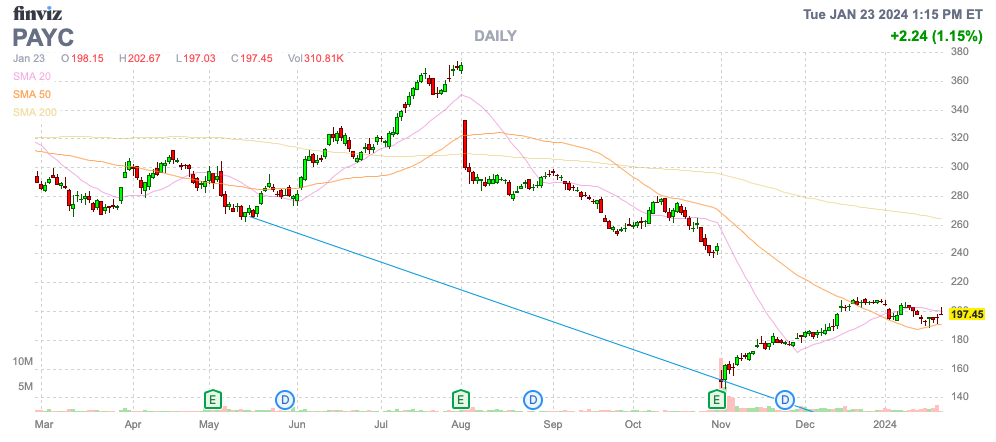

Paycom Software, Inc. (NYSE:PAYC) has done such a good job that the company is solving too many problems for customers. The payroll software company had to cut numbers due to customers reducing billing for unscheduled events. My investment thesis is Neutral on the stock heading into Q4'23 earnings (expected post-market on February 7th) due to the risks for additional warnings.

Source: Finviz

Self Inflicted Wounds

Back in mid-2021, Paycom released a new payroll software program called Beti (Better Employee Transaction Interface). The product allows employees to fix payroll errors before submitting data for payroll cycles, and apparently works so well the company is watching one-off revenues disappear.

Source: Beti

In the long run, customers are happier, and Paycom will have a more loyal customer base and possibly help marketing for signing up new customers. In the short run, the human capital management software company will report far lower growth rates until the vast majority of customers are on the new cloud-based software.

On the Q3 '23 earnings call, Paycom CFO Craig Boelte made the following statement:

Now that more clients are achieving the ROI that Beti has to offer, it has eliminated certain billable items, which is cannibalizing a portion of our services and unscheduled revenues.

Unfortunately, Paycom doesn't provide any revenue details to derive the financial impact of billables from unscheduled revenues. The company reported Q3 revenue for non-recurring, implementation revenues of only $7.5 million.

According to Nucleus Research, organizations are able to eliminate 80% of payroll errors once implementing the Beti feature, saving a company an average of 8 hours per 100 employees. Paycom had previously pointed investors to an EY Survey suggesting payroll errors cost $291 each.

The CEO suggested clients have 50% of employees on Beti, but the company wasn't clear whether this was 50% of clients currently using the payroll software or 50% of all clients. Paycom suggested 2/3s of clients on the software. Either way, Paycom still faces of 50% of clients shifting to the new software reducing billables.

Telling Q4 Coming Up

Paycom is set to report Q4 '23 earnings after the market closes on February 7. The company guided to following numbers for the December quarter:

- Total Revenues in the range of $420 million to $425 million.

- Adjusted EBITDA in the range of $169 million to $174 million.

The consensus analyst estimates have revenues falling within this range at $422 million, with Q1 '24 revenues of $500 million for sub-11% growth. Paycom shocked the market by guiding to 2024 revenue growth only in the 10% to 12% range.

The market originally expected revenues of $452 million for the December quarter. Paycom will likely miss those targets by $30 million.

The big question not really answered with the Q3 '23 earnings report was when Paycom hits the inflection point of where the unscheduled revenues dip far enough and revenue from new logo additions top the lost revenue. Remember, the new logos won't generate the unscheduled revenue, so the issue is only with existing customers transitioning employees to Beti.

The company suggested 2/3s of customers are on Beti now, with possibly 50% of employees of those clients on the software. If revenue grows by $200 million to reach $1.87 billion in 2024, the presumption is that at least $200 million worth of unscheduled revenues are being lost this year due to Beti. The real unknown is whether this cuts out the majority of the unscheduled revenue heading into 2025, with corporations still facing around 20% error rates incorporated into the numbers.

Paycom could be looking at a stronger 2025 with no further impact from lost one-off revenues while new logos are signing up to the program due the savings from the elimination of errors. The market forecasts only 13% sales growth next year and the expectation would be for better results once the company turns the corner.

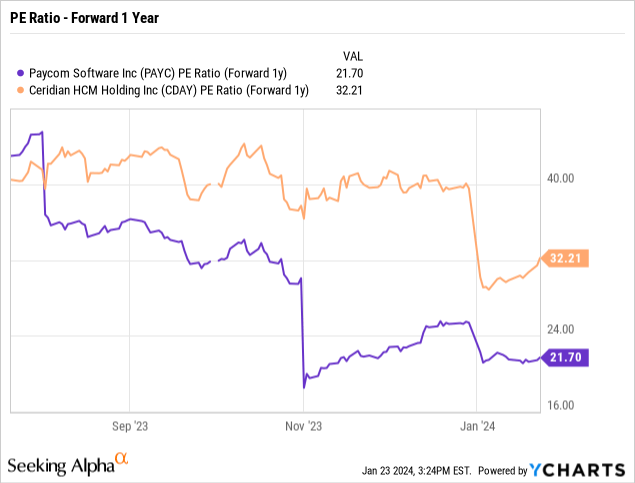

The stock still trades at 24x 2024 EPS targets of $8.11. After a recent warning, the bigger risk to the investment story is a follow-up warning as the acceleration to Beti occurs faster.

UBS is bullish on Paycom with a $235 price target. The analyst is also bullish on Ceridian HCM Holding (CDAY), with a far higher forward P/E multiple here.

Paycom could easily recapture a higher P/E multiple by transitioning back to solid growth rates by 2025. Ceridian only has a 15% sales growth target for 2024.

The payroll company is in a highly dynamic environment where customers are only now learning how to use Beti to fully reduce payroll errors. The biggest risk in the short term is that the pace of client employees utilizing the software could pick up even faster.

Paycom becomes a compelling story when growth rates normalize and EPS growth returns to 20%+. The stock traded above $350 and the company in 2025 will be much larger.

Takeaway

The key investor takeaway is that Paycom is a show me story heading into the Q4 '23 results. The company has to convince the market the unscheduled billings hit will end during 2024 allowing the business to return to fast growth rates in 2025. The risk is that the stock has rallied back towards $200 and Paycom could retest the lows around $150 without a convincing earnings report showing a turnaround is likely.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.