Apple's first fiscal quarterly results will be released by the company on February 1. Here's what happened in the holiday quarter, and what to expect the iPhone maker to reveal to investors.

Apple confirmed on January 8 that it will be holding its holiday quarter earnings call on Thursday, February 1, 2024. The call, which will occur at 5 p.m. Eastern, will involve CEO Tim Cook and CFO Luca Maestri explaining to investors and analysts some of the details from Apple's Q1 2024 results, due at around 4:30 p.m. ET.

Last Quarter: Q4 details

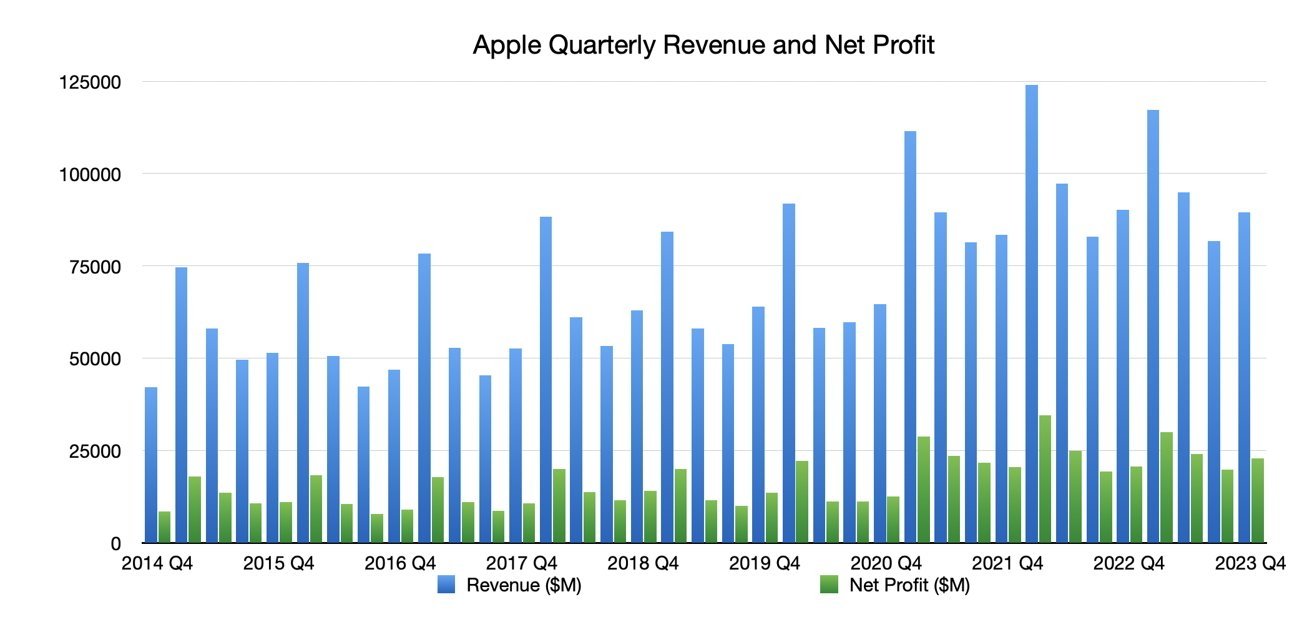

The Q4 results for the 2023 fiscal year was a mixed one for Apple, as it incurred its fourth consecutive YoY revenue drop in four consecutive quarters. However, it still beat the expectations of Wall Street.

For the quarter, Apple secured $89.5 billion of revenue, which is down from the $90.1 billion reported in Q4 2022. Apple also declared an earnings per share of $1.46.

In the period, iPhone revenue rose YoY from $42.6 billion to $43.8 billion. This offset the reduced iPad revenue from $7.17 billion in Q4 2022 to $6.43 billion in Q4 2023.

Mac revenue was down a lot from its $11.5 billion Q4 2022 figure, managing just $7.61 billion for Q4 2023. Wearables, Home, and Accessories was also down, but only just at $9.32 billion versus $9.65 billion.

Services continued to be a dependable sector, with growth from $19.19 billion one year prior to $22.31 billion.

Cook characterized the results as a September quarter record for iPhone revenue, and an all-time Services revenue record. Maestri added that Apple's active installed base of devices reached a new all-time high across all products and geographic segments.

For Q1 2024, Apple did warn of a potential deceleration of wearables sales, with the ITC sales ban causing problems for the Apple Watch in the United States. It also offered expectations that Mac sales would grow.

In post-results analysis, analysts were quick to claim Apple had mixed results that were in line with consensus, but they were also quick to move on to Q1 results speculation.

Year-Ago Quarter: Q1 2023

Four quarters before Q1 2024, Q1 2023 saw Apple haul in $117.15 billion in revenue. This was a decline from the year-previous quarter, which was Apple's record-setting $123.9 billion revenue quarter, and it also marked Apple's first year-on-year quarterly drop in revenue since 2019.

For the period, Apple's earnings per share was $1.88, down from $210 one year prior.

As usual, iPhone brought in the most at $65.78 billion for the quarter, though this too was a drop from $71.6 billion in the same quarter one year ago. Zhengzhou factory issues were blamed for part of the shortfall.

Revenue from iPad rose from $8.4 billion for Q1 2022 to $9.4 billion for Q1 2023, with Services also up from $19.5 billion to $20.77 billion.

Mac revenue dropped year-on-year from $10.8 billion to $7.74 billion, and Wearables, Home, and Accessories dipped from $14.7 billion to $13.48 billion.

What Happened in Q1 2024

Q1 results are, historically, the biggest money earner for Apple across the entire year, and for multiple good reasons.

The chief one is that it's the quarter when Apple's iPhones are bought by the public. Though the iPhone 15, iPhone 15 Plus, iPhone 15 Pro, and iPhone 15 Pro Max shipped on September 22, the end of Q4 2023, Q1 2024 will be the first full quarter to feature sales and shipments of the models.

Along with the iPhones, Apple also introduced the Apple Watch Series 9 and Apple Watch Ultra 2. Though the ITC ban has caused limited sales issues in the United States, the ban doesn't affect sales elsewhere in the world.

Apple also refreshed its AirPods Pro 2 at the same time, adding a USB-C case.

Massive sales of Apple's product catalog are all but guaranteed as well, since they occur during the high-selling holiday sales period.

Excitement about the Apple Vision Pro may have helped sales, but since it won't be releasing until February 2, and in relatively limited numbers versus an iPhone release, it won't make that much of a splash until the Q2 results.

What Wall Street Thinks

Figures sourced from Yahoo Finance on January 27 based on 22 analyst opinions puts Apple as earning $108.37 billion as an average, with a high estimate of $113.99 billion and a low of $108.37 billion.

The earnings per share, based on 26 analyst opinions, could be at $1.93, with high and low estimates of $1.98 and $1.88.

CNN Money offered its own analyst survey figures. As of January 27, the consensus forecast sales of $126.1 billion, with a high of $131.6 billion and a low of $114.2 billion.

The EPS in this case is expected to be at $2.15, with highs and lows of $2.51 and $1.72.

On Marketwatch on January 27, its analyst forecast averages the EPS at $2.10, with a high estimate of $2.17 and a low of $2.02.