Tokyo Century Leasing leads Motorist’s Series A round

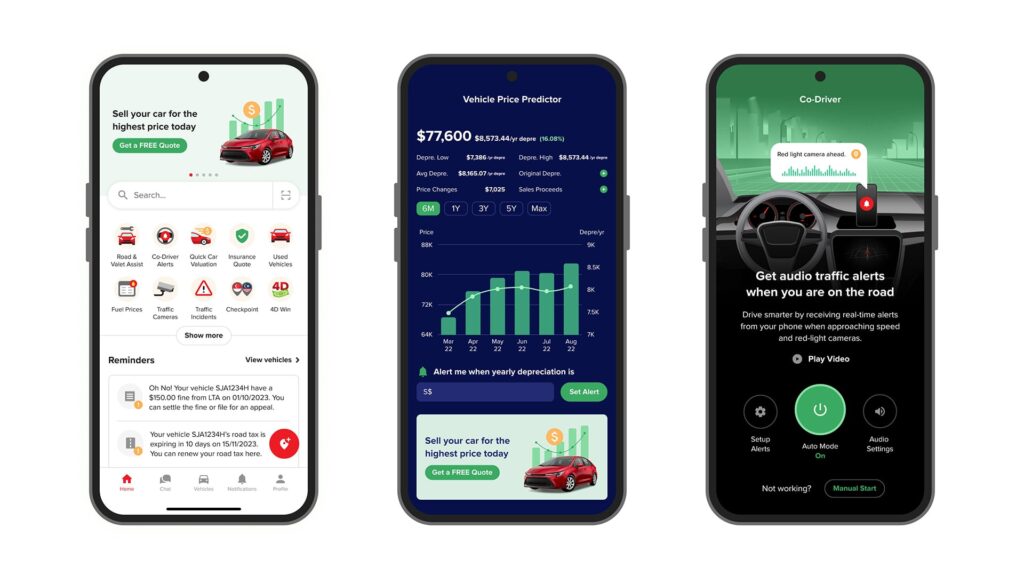

Motorist, a Singapore-based automotive technology company, has announced that Tokyo Century Leasing is leading its Series A funding round as a strategic investor. Existing investors from an AngelCentral syndicate have also participated in this round.

Although the exact sum raised has not been disclosed, the company clarified that this is an ongoing round, and it is actively seeking additional investors. Motorist expressed keen interest in collaborating with entities that share its vision of transforming the automotive industry.

Operating an app that simplifies vehicle management, Motorist currently serves approximately 15% of vehicle owners in Singapore. With a presence in Singapore, Malaysia, Thailand, and Vietnam, the company aims to expand its reach to cover ten countries by 2026, including the Philippines.

This latest deal has elevated Motorist’s valuation to USD 60 million.

Singapore’s GDMC secures USD 21 million in Series A round

Genetic Design and Manufacturing Corporation (GDMC), a design and manufacturing organization that specializes in advanced genetic therapies, has secured USD 21 million in a Series A funding round led by Celadon Partners. The round included participation from WI Harper Group, SEEDS Capital (Enterprise Singapore), and NSG Ventures, among other unnamed investors.

GDMC intends to use the newly raised capital to expedite the development of novel technology and enhancements aimed at improving process efficiency, thus driving greater manufacturing cost reductions for its partners. The company also expressed its aspiration to cultivate stronger collaborations with partners in the US and the APAC region, working together to enhance the state of healthcare and treatment for patients.

“GDMC is uniquely positioned in the genetic medicines supply chain and we believe that Singapore provides a compelling value proposition for customers in terms of both a deep talent pool and cutting-edge technologies,” said Jonathan Su, managing director at Celadon Partners.

Prism BioLab raises JPY 1.5 billion in Series C round

Prism BioLab, a Fujisawa-headquartered biotechnology company, has raised JPY 1.5 billion (USD 10.1 million) in a Series C funding round. The company did not disclose the investor details for this round.

According to a statement by Prism BioLab, the capital will be used to refine its proprietary chemistry platform, enhance its biology and screening capabilities, and to advance an internal pipeline of protein-protein interaction (PPI) inhibitors.

Arkon Energy secures new investment, attaining USD 223 million valuation

Arkon Energy, a Melbourne-based data center infrastructure company, has secured USD 110 million in debt and equity financing from various international investors. The funding round, led by Blue Sky Capital Management, also saw participation from Kestrel 0x1 and Nural Capital.

The deal structure includes USD 23 million in equity and USD 61 million in debt, with the debt to be drawn in three tranches based on the cost of constructing Arkon’s new data centers in the US. Following the completion of this deal, Arkon is now valued at USD 223 million.

According to Joshua Payne, the CEO of the company, Arkon plans to pursue a public listing within the next six months. The capital raised will be used to continue growing the business. Notably, Arkon transitioned from its previous focus on consulting to its current specialization in data center infrastructure. —Australian Financial Review

Recent deals completed in China:

- Zhice Information Technology (Sense Decision), a Shanghai-registered developer of advanced industrial and manufacturing software, has raised an eight-figure RMB sum of seed funding from Shunwei Capital. It will use the funds for product R&D and marketing. —36Kr

- Grandeur Microelectronics, a Wuhan-based company that develops radio frequency (RF) components, has announced the completion of its Series B funding round, securing RMB 200 million (USD 28.2 million). The round saw participation from Ningbo Entrepreneurs Industrial, Hubei Railway Development Fund, Changjiang Capital, Hunan Hi-tech Investment Group, and seven other unnamed investors. Grandeur will utilize the capital for production capacity expansion and company operations. Grandeur last raised funding six months ago when it closed its Series A+ round, securing an investment from Xiaomi. —36Kr

- 97 Caijing, an offshore bond platform, has completed its Series A funding round, attaining a post-money valuation of RMB 100 million (USD 14.1 million). It did not disclose the names of the investors that took part in this round. —36Kr

- Scienpharm Biotechnology, a Shanghai-headquartered technology enterprise specializing in the development of high-end drugs and consistency evaluation of injections, has completed its inaugural round of strategic financing, raising an undisclosed amount from Minsheng Pharmaceutical and Anbison Lab. —36Kr

- Noah Fluorochemical, a Hangzhou-based company focused on the R&D, manufacturing, and sales of fluorine-containing electronic chemicals, has concluded a new strategic financing round. The amount raised was not disclosed. The investment was led by Sinopec Capital’s Enze Fund with the support of Phoenix Tree Capital Group and Sinowisdom. —36Kr

- Chasing-Innovation Technology, a Shenzhen-headquartered company specializing in the development of underwater drones, robots, and unmanned equipment, has bagged an eight-figure RMB sum of Series B funding from Zhengxi Capital. The company will utilize the funds to develop its products, enhance its supply chain, and double down on marketing. —36Kr

- Niu Company, the Shenzhen-headquartered company behind Chinese fast food chain Niu Daji, has banked RMB 82 million (USD 11.5 million) following the completion of its Series B1 funding round. The round was led by Chunjian Capital and saw participation from Deepbear Capital. It will use the newly raised capital to support supply chain developments and its domestic expansion plans. —36Kr

- Orienspace, a rocket and launch vehicle developer, has raised around RMB 600 million (USD 84.7 million) amidst rising demand for commercial satellite launches in China. The investors include the Liangxi Science and Technology Innovation Industry Fund of Funds, which is managed by Broad Vision Funds, Shenyin & Wanguo Investment, Hongtai Aplus, Xin Ding Capital, and existing backers such as Hike Capital. Orienspace intends to allocate the funds toward the R&D and manufacturing of an in-house rocket engine based on liquid oxygen and kerosene, and the development of its reusable Gravity-2 rocket. —36Kr

- Tongzhou Yunchuang, the Shenzhen-registered company that operates MyBooster, a cross-border e-commerce financial service provider, has completed an angel funding round, securing an undisclosed amount of investment from QF Capital and Futian Investment Holdings. The capital will be used for capacity building and product development. —36Kr

- HL Intelligent Tech, a manufacturer of high-precision components for consumer electronics, has banked a nine-figure RMB sum following the completion of a Series A funding round led by SparkEdge Capital. —36Kr

- Youqianla, a Guangzhou-based food and catering operations company focused on serving Guizhou cuisine, has snagged RMB 15 million (USD 2.1 million) in strategic financing from a fund managed by Zhongqing Capital. The funds will be used primarily to fast-track the expansion of the company’s operations. —36Kr

- Huasheng Haoche, a Tianjin-headquartered automotive retail platform, has secured RMB 650 million (USD 91.7 million) in a new funding round led by a state-owned investor. The company did not disclose the details of investors that participated in this round, but said it will use the capital to expand its sales network and expand the number of its brick-and-mortar retail stores. —DealStreetAsia

Latest funding deals in India:

- Ecofy, a Mumbai-based non-banking finance company (NBFC), has secured INR 900 million (USD 10.8 million) in an equity funding round from FMO. This investment will support Ecofy’s growth initiatives, enabling the expansion of its loan book, diversification of its product base, and improvement of its credit rating. Ecofy specializes in financing electric two- and three-wheelers and supports businesses working toward reducing climate impact, offering both term loans and working capital loans for these entities. —The Economic Times

- Flaer, a home interiors materials startup, has raised USD 2.5 million in a pre-seed funding round from Singularity Ventures, the family office of Manish Choksi (Asian Paints), and three undisclosed angel investors. The startup is aiming to utilize the capital to establish product-market fit, and anticipates becoming fully operational within the next three months. —VCCircle

- Fixerra (formerly known as Fixed Invest), a fintech startup, has secured USD 1.7 million in a seed funding round led by Jaideep Hansraj and Shailesh Haribhakti. The round includes participation from Oisharya Das, Shivang Desai, and the family office of Harish Shah. Fixerra will use the funds to expand its banking partnerships and enhance its product features. —VCCircle

- Docosage, an artificial intelligence-based health tech startup based in New Delhi, has raised an undisclosed amount of investment in a pre-seed funding round led by angel investor Mayur Agarwal. The startup will utilize the capital for product development, enhancement of its AI capabilities for health insights, and to conduct early-stage testing of its telehealth and genetic studies platform. —VCCircle

- Vivifi India Finance, a Hyderabad-based NBFC, has raised USD 75 million in a Series B funding round from an undisclosed US investor. The deal comprised a mix of equity and debt financing. Vivifi plans to use the capital to expand its financial services to underserved communities. The company is also aiming to grow its workforce and establish offices in tier-two and tier-three cities in Telangana and Andhra Pradesh, with broader nationwide expansion on the horizon. —VCCircle

HutanBio, Masa Network, Ultra Violette, and more led yesterday’s headlines:

- HutanBio, a biotechnology company specializing in the development of biofuels, snagged GBP 2.25 million (USD 2.85 million) in investment from the Clean Growth Fund.

- Masa Network, one of the leading decentralized data marketplaces, raised USD 5.4 million in a seed funding round led by Anagram. Other investors that took part in this round include Avalanche Blizzard Fund, Digital Currency Group, GoldenTree, OP Crypto, Unshackled Ventures, and Peer VC, among others.

- Ultra Violette, a Melbourne-based sunscreen company, secured AUD 15 million (USD 9.8 million) from Aria Growth Partners. This deal was facilitated by Canterbury Partners.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].