Tesla (TSLA) is scheduled to report quarterly results Wednesday after market close, giving investors a look under the hood at the company’s financial performance as its operations in China ramped well ahead of schedule and deliveries hit a fresh record.

Here are the main metrics expected from Tesla’s fourth-quarter 2019 report, compared to consensus expectations compiled by Bloomberg:

Revenue: $7.05 billion vs. $7.23 billion Y/Y

Adjusted earnings per share: $1.74, vs. $1.93 Y/Y

Tesla’s stock has more than doubled since its third-quarter earnings results in October, surging well above the $420 per-share level CEO Elon Musk once considered in a dropped plan to take the company private. That’s brought the company’s market capitalization to more than $100 billion, or more than than of General Motors and Ford combined.

Those share gains coincided with a surprise third-quarter profit, record-breaking delivery results in the last three months of the year and a faster-than-expected completion of the company’s Shanghai Gigafactory.

“It is well understood Tesla will report an impressive 4Q19 result,” Craig Irwin, analyst for Roth Capital Partners, said in a note.

In the fourth quarter, Tesla delivered a total of 112,000 vehicles globally, topping expectations and bringing full-year deliveries to about 367,500, hitting the company’s guidance of delivering between 360,000 and 400,000 vehicles in 2019.

Meanwhile, Tesla delivered its first cars built at its Shanghai Gigafactory to local Chinese customers earlier this month, having ramped up production to 1,000 cars per week in China less than a year after breaking ground on the facility.

“Up until recently, manufacturing and product quality has been a drag rather than an asset, because Tesla lacked the economies of scale and experience in large-scale production,” UBS analyst Patrick Hummel wrote in a note. “However, the company likely has passed an inflection point, i.e., manufacturing has now become an asset because Tesla is now better and more efficient in producing its EVs (electric vehicles) than anybody else.”

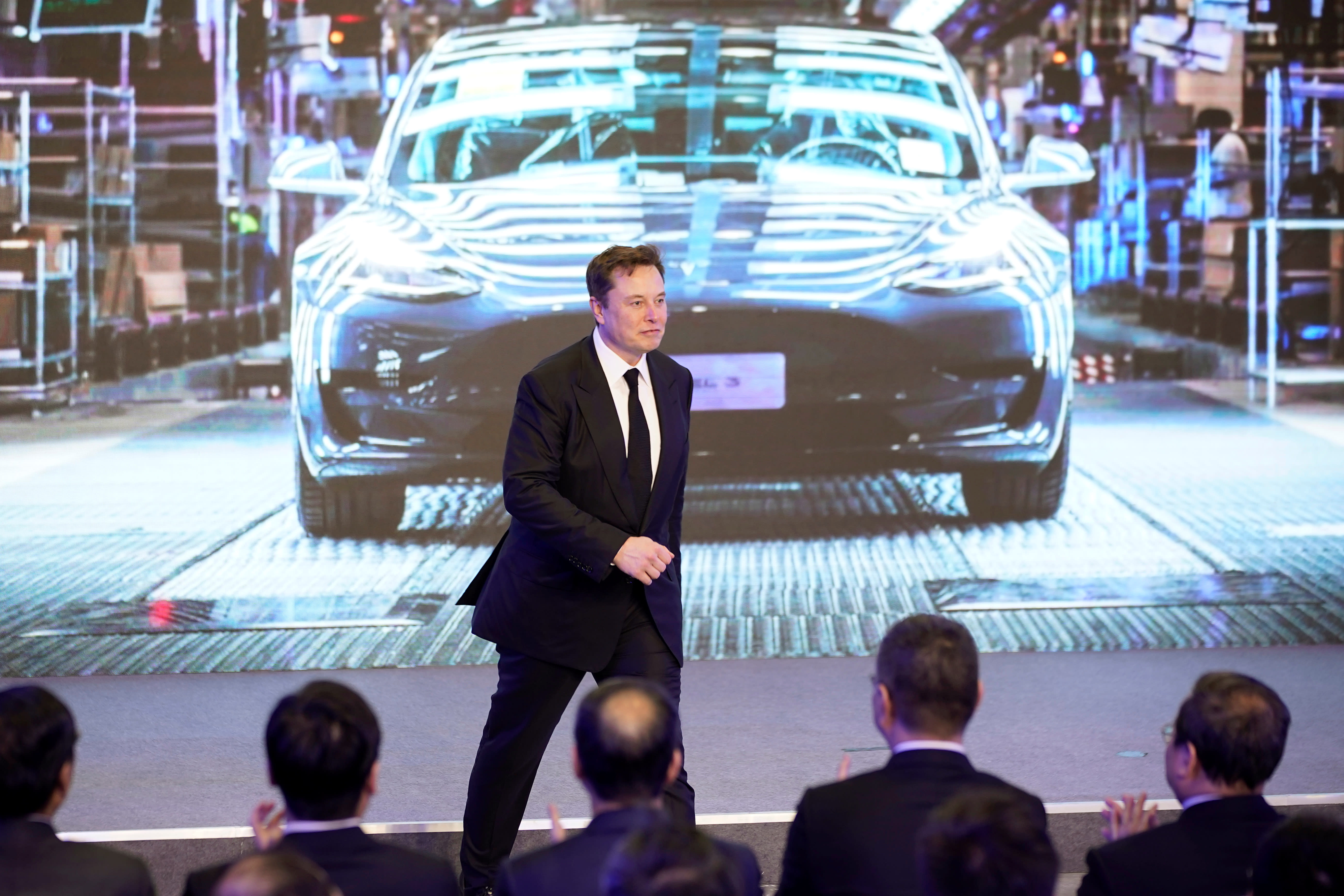

Tesla Inc CEO Elon Musk attends an opening ceremony for Tesla China-made Model Y program in Shanghai, China January 7, 2020. REUTERS/Aly Song

Looking ahead

With these victories already well-known, the Street will be combing through Tesla’s report to see how these translated to the company’s financial results, and what the company sees for the current year and beyond in order as justification for the stock’s rapid run-up in valuation.

While many analysts lauded Tesla for its fourth-quarter developments, most remain on the sidelines in recommending that investors buy the stock at current levels. As of Tuesday, nine firms rated the stock as with a Buy or Buy-rating equivalent, 11 rated the stock as Hold and 17 rated it as Sell, according to Bloomberg-compiled data.

“We view Tesla as the OEM with the biggest long-term AV opportunity. We believe this justifies a market cap well above most incumbent OEMs,” Hummel said. “However, Tesla shares now discount 1.6m vehicles sold in 2025 (vs. 367.5k in 2019) at 11% OP (operating) margin, after doubling in value since Q3 results. Risks in execution and U.S. demand following the phase-out of EV tax credits seem to get ignored.”

UBS highlighted three key volume drivers for Tesla over the next three years: its localized production in Shanghai with a targeted eventual run-rate of 500,000 units per year, global Model Y crossover vehicle launch expected in the second quarter of 2020 and Cybertruck production launch in late 2021. The former two points could catalyze gross margin expansion, with the Shanghai Gigafactory lowering local production costs for Tesla vehicles, and the Model Y expected to be sold at a higher price point than the Model 3 and “outsell S, X and 3 combined,” Musk said last quarter.

For Oppenheimer, a firm rating Tesla as Outperform, the debate around the stock will continue to center on three main questions.

“First, ‘Can TSLA scale to 1M annual vehicle deliveries in the next 4-5 years?’ Second, ‘Can TSLA achieve double-digit operating margins at 1M vehicles/year?’ Third, ‘Can TSLA leverage its fleet size advantage into a time to market advantage in delivering full autonomous vehicles?’” Oppenheimer analyst Colin Rusch wrote in a note. “We believe shares will trade along progress of those metrics while continuing to be volatile along the way.”

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Bridgewater: Stocks are more expensive in the U.S. than anywhere else in the world

Netflix 4Q subscriber growth tops expectations, but guidance disappoints

Tesla has a ‘key advantage’ over other automakers, analyst says

Why traders playing oil like it’s 2010 are ‘getting their heads handed to them’

Valuations aren’t overstretched after record year for stocks, strategist says

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news