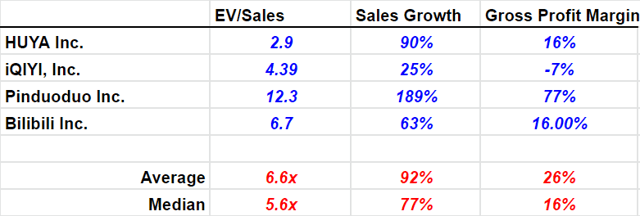

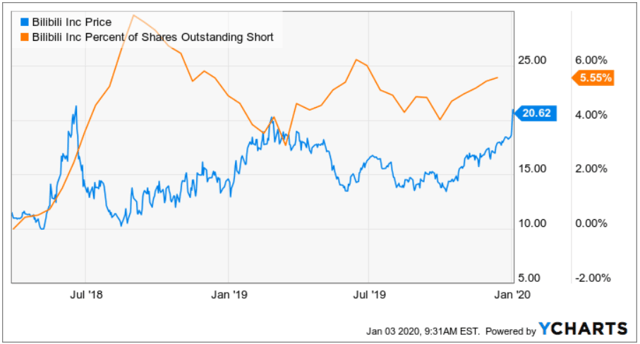

With the market expecting sales growth of 46% in 2020, Bilibili (BILI) should not be trading at 6.7x sales. In our view, as revenue growth declines, the company’s EV/Sales ratio will decline. Investors need to be careful. If they buy at the current share price, they may lose a significant part of their investment. Note that other Chinese companies are trading at an average of 6.6x and a median of 5.6x sales with an average revenue growth of 92%. Besides, notice that the amount of short sellers increased in the last two months. In our view, a short position on Bilibili would make sense.

Bilibili Learns How To Monetize Its Platform

Launched in 2010, Bilibili is a Chinese platform offering online entertainment thought videos, live broadcasting, and mobile games. Source: Bilibili’s Website

Source: Bilibili’s Website

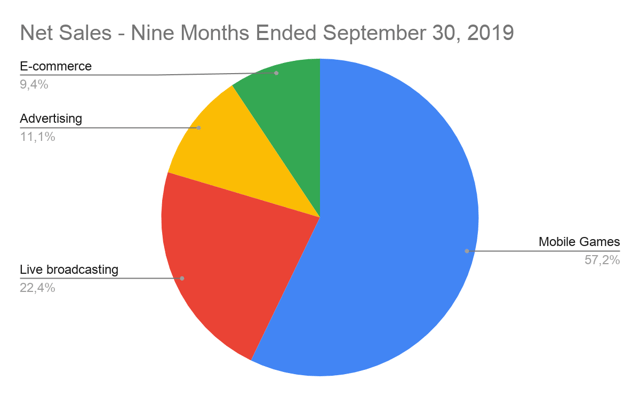

As shown in the sale breakdown below, the company’s most significant activity in terms of revenue is the sale of mobile games. In the nine months ended September 30, 2019, the sale of mobile games was responsible for 57.2% of the total amount of revenue. Net sales from this business segment are also increasing at a high pace. The figure increased by 25% as compared to the same period in 2018. Bilibili explained that sales growth was due to the increasing popularity of the company’s launched mobile games.

Source: 10-Q

In the nine months ended September 30, 2019, live broadcasting was responsible for 22.4% of the total amount of sales. However, what investors will appreciate the most is the sales growth that has beem experienced by this business unit. The net sales reported represented 167% increase as compared to the same period in 2018. The company appears to be learning how to monetize its platform. The amount of paying users for live broadcasting services is increasing at a high pace.

Finally, advertising and e-commerce sales are not responsible for a significant amount of sales. They represent less than 21% of the total amount of revenue. However, their sales growth is even more impressive than that of the other business units. In the cited period, sales from advertising increased by 80% and that of E-commerce increased by 703%.

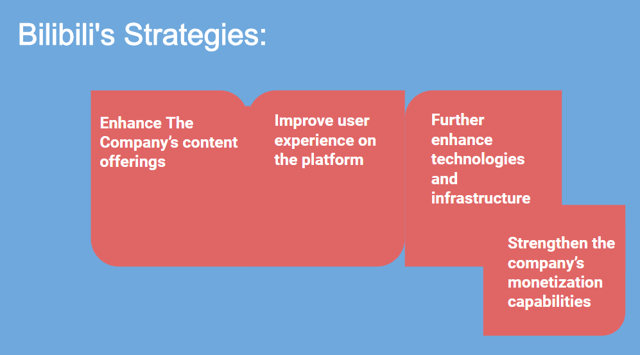

Given the massive increase in revenue, we wondered what the current strategy of Bilibili Inc is. According to the prospectus, the company is focused on improving user experience, enhancing technologies, and monetization among other initiatives. The company has been doing the same since the IPO was executed in March 2018. However, it seems that the initiatives worked out in Q3 2019:

Source: Prospectus

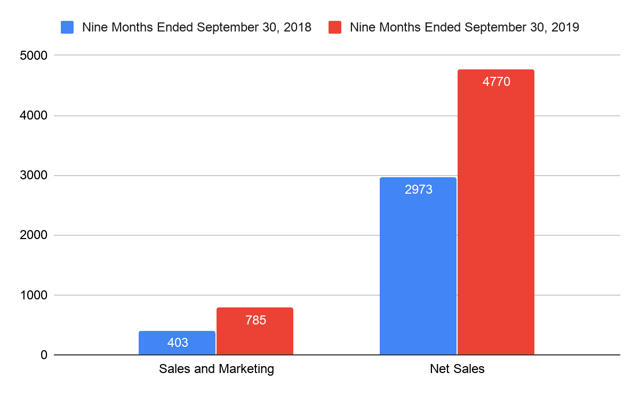

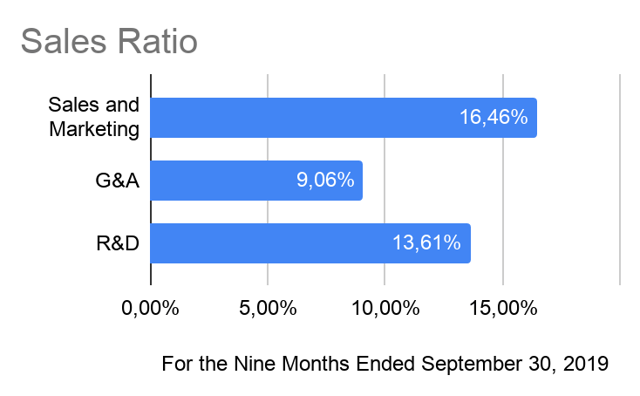

Notice in the chart below how, in the nine months ended September 30, 2019, net sales increased to 60% as compared to the same period in 2018. Note that Bilibili Inc. increased the amount of sales and marketing efforts in the same period. However, the amount of revenue obtained is way larger than the amount spent in marketing:

Source: 10-Q (in Thousands of RMB)

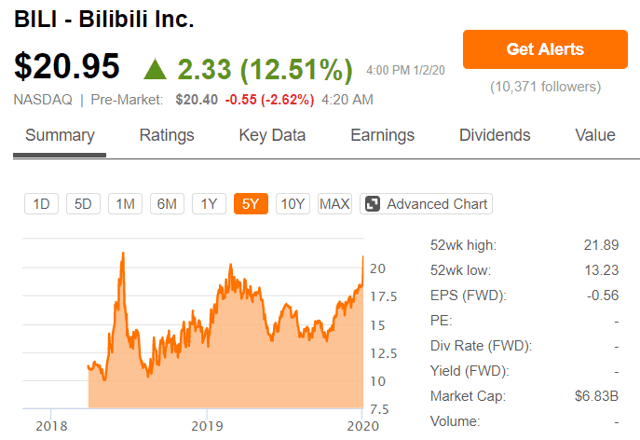

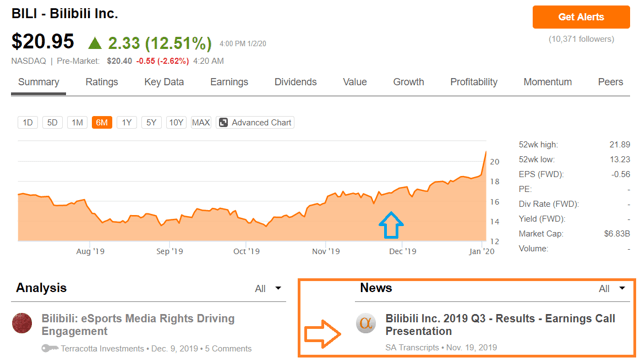

Market participants took some weeks before reacting to the figures noted in Q3 2019. In November 2019, when the press release was released, the ADSs were trading at $16. Right now, investors are buying shares at $20.95. The share price increase represents stock returns exceeding 30% in less than two months:

Source: Seeking Alpha

Source: Seeking Alpha

The CEO Is The Founder Of Cheetah Mobile

We do believe that Bilibili has done an impressive work in bringing new users to the platform. With this in mind, we studied the company’s management and, more precisely, the business profile of the CEO, Rui Chen. He is not only an entrepreneur, but also an expert in the mobile industry. He was the founder of Cheetah Mobile (NYSE:CMCM), a Chinese mobile Internet company offering internet security software. We believe that Bilibili made a brilliant move by appointing Mr. Chen as the CEO. Clearly, his experience of engaging new users for Cheetah Mobile is being used. See below more information about this business executive:

Source: Cgtn

Source: Company’s Website

Regarding the role of Mr. Chen, we need to point out that we dislike his appointment as CEO and Chairman of the Board Of Directors. The Board of Directors needs to represent the interest of shareholders. When the CEO is also the chairman of the Board, she/he may decide to protect her/his position. There may also exist an agency problem, which, in our view, most shareholders will dislike. There is plenty of literature on the subject:

Source: Should Chairman and CEO be Separated?

Source: Journal Of Corporate Finance

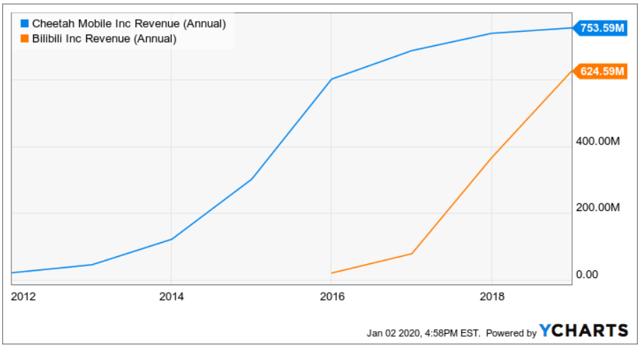

Sales Growth Of Cheetah Mobile And Bilibili

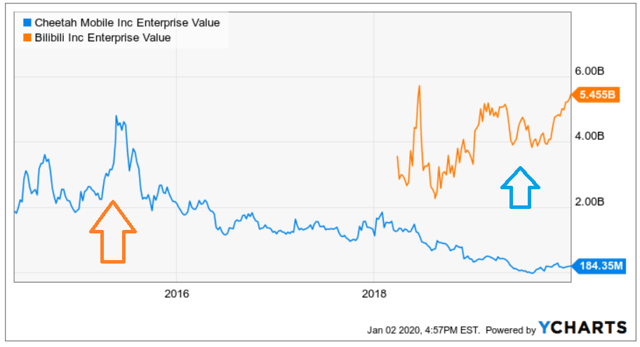

Bilibili’s CEO was the founder of Cheetah Mobile. In our view, understanding Cheetah’s sales growth and market performance may say a bit about the future of Bilibili. As shown in the image below, the sales growth of both companies is very similar. Both corporations reported impressive sales growth in less than two years. From 2014 to 2016, Cheetah Mobile reported a sales jump from ~$150 million to more than $600 million. Bilibili’s growth commenced in 2017-2018, but it is as strong as that of Cheetah. In 2019, revenue is equal to more than $600 million:

Source: Ycharts

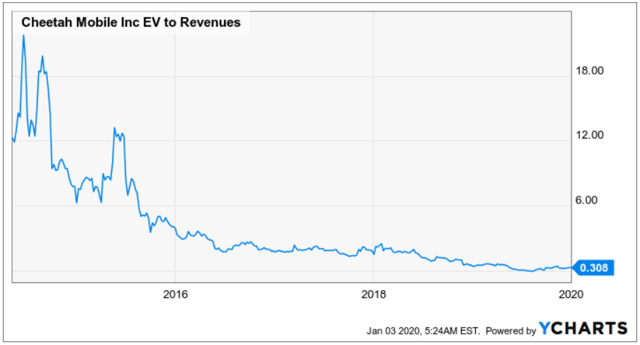

The analysis of Cheetah’s enterprise value is also very interesting. In 2016, Cheetah’s enterprise value spiked up to more than $4 billion or 12x sales before heading down to less than 0.5x sales. The decline in Cheetah’s enterprise value commenced when the company’s sales growth declined. Note that in 2017-2018, Cheetah’s sales growth stabilized at $700-$800 million. As a result, the EV/Sales ratio declined as investors did not expect more massive revenue growth:

Source: Ycharts

Source: Ycharts - EV/S

In the past, Bilibili’s revenue growth was quite impressive. However, the company may not be able to offer the same revenue growth forever. Analysts expect sales growth of 63% in 2019, 46% in 2020, and 31% in 2021. Like the case of Cheetah, Bilibili will most likely see a decline in its EV/Sales ratio as sales growth declines. With this in mind, investors should try to buy Bilibili’s shares at an EV/Sales ratio that is not very elevated.

Source: 10-Q (in Thousands of RMB)

With regards to the company’s profitability, the company appears to be well-managed. The company’s Marketing Costs/Sales were below 17% in the nine months ended September 30, 2019. R&D/Sales and G&A/Sales are also below 15%. See more details in the table below:

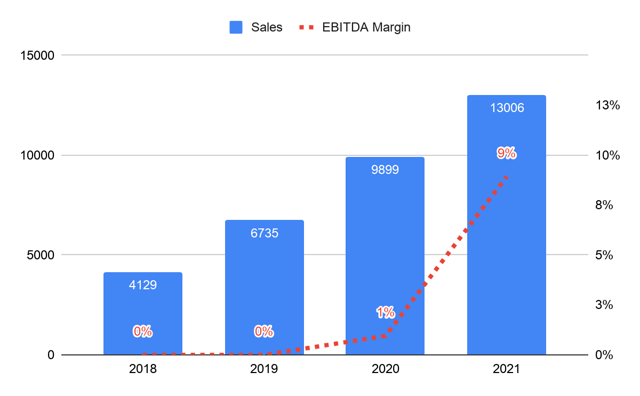

The EBITDA Margin is expected to be positive at 9% in 2021. Also, in 2021, net income is expected to be RMB 38 million. In light of these figures, in our opinion, value investors will commence to take a look at the company from 2021. Right now, the company only seems interesting for growth investors.

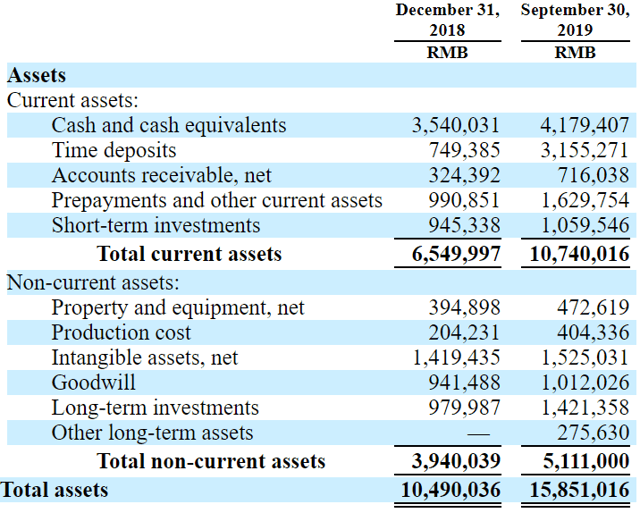

The Company Is Cash Rich

What we appreciate on Bilibili is its cash in hand. As of September 30, 2019, the company reports RMB 4.179 billion or $600 million in cash and RMB 1059 million or $151 million in short-term investments. Approximately 33% of the total amount of assets is comprised of liquid assets. Thus, the company has sufficient liquidity to invest in additional marketing efforts. See the image below for more on the company’s assets:

Source: 10-Q (in Thousands of RMB)

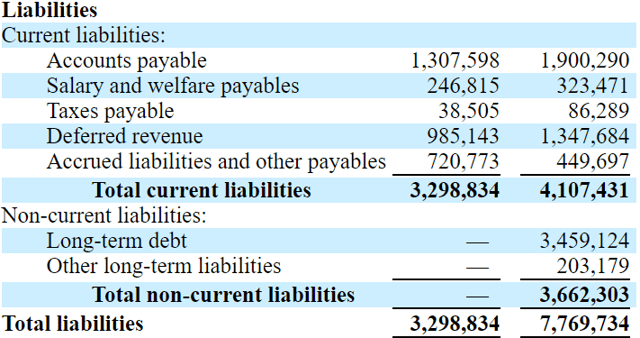

With regards to the total amount of long term debt, most investors will not be worried. Long-term debt is equal to RMB 3.459 billion or $500 million, which is below the total amount of cash. Besides, the company’s financial stability is stable at an asset/liability ratio of 2x:

Source: 10-Q (in Thousands of RMB)

Valuation: The Share Count Is Increasing At A High Pace

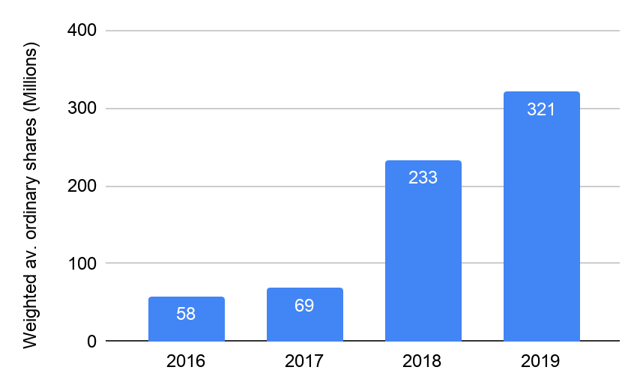

With a share count of 321 million and a market price of $20.95, the market capitalization is $6.7 billion. With debt of $500 million and cash of $751 million, the enterprise value is equal to $6.4 billion. Investors need to study the share count closely. It has multiplied by more than 4x in the last three years. We don’t expect the company to need a lot of cash soon. However, it is good to remember that Bilibili tends to sell equity. This could lead to share price depreciation:

Source: 10-Q

If we use 2019 Sales of RMB 6.735 billion or $966 million, Bilibili trades at 6.7x sales. Considering sales growth of 63% in 2019, it is a bit expensive. Other Chinese companies operating in the United States trade at a median of 6.6x and a median of 5.6x with sales growth of 77%. Bilibili’s valuation is not extremely high, but we don’t expect the stock to have a lot of upside potential. There are other companies trading at a cheaper valuation like Huya (HUYA), which trades at 2.9x sales with larger sales growth than Bilibili:

Source: Seeking Alpha And Author’s

Considering the table above and the company’s gross profit margin of 16%, we see a fair P/S valuation for Bilibili’s valuation at 3.5x-5x. If the company trades below 3.5x or $11 per ADS, we would acquire shares.

We would understand short sellers who decide to take positions in the company. The percent of shares outstanding short is equal to 5.5%. In our view, the company’s current sales growth does not justify an EV/Sales ratio of 6.7x. With that, short sellers should understand that Bilibili is a growth company. Even if they are correct, the share price may creep up before heading down.

Source: Ycharts

Potential Risks

Among the different risks highlighted in the prospectus, we believe that the company’s main risk would come from a decline in sales growth. As a result, the EV/Sales ratio would decline. The company is also at an early stage of development and has a limited operating history, which most investors will dislike. Read the lines below for more details on the matter:

“We are in the early stage of our business, and our monetization model is evolving. We generate revenues primarily by providing our users with valuable content, such as mobile games and live broadcasting. We also generate revenues from advertising and other services. We cannot assure you that we can successfully implement the existing monetization strategies to generate sustainable revenues, or that we will be able to develop new monetization strategies to grow our revenues. If our strategic initiatives do not enhance our ability to monetize or enable us to develop new monetization approaches, we may not be able to maintain or increase our revenues or recover any associated costs.” Source: Prospectus

There are also two mobile games, which were responsible for more than 85.4% of the total amount of mobile game sales. Third-party game developers may not renew their agreements with the company. As a result, net sales would decline. The lines below offer additional details on this risk:

“In 2018, two mobile games accounted for more than 10% of our total mobile game revenues, one for 74.4% and the other for 11.0%. We offer mobile games from third-party game developers and publishers on our platform either on an exclusive or non-exclusive basis. Therefore, we must maintain good relationships with our third-party game developers and copyright owners to obtain access to new popular games on reasonable commercial terms. We may not be able to maintain or renew these agreements on acceptable terms or at all.” Source: Prospectus

Conclusion

Bilibili has reported impressive sales growth in 2019, tons of cash, and has an experienced CEO. With that, there are a few features that are not that great. Firstly, the share price of more than $20 and an EV/Sales ratio of 6.7x sales are expensive. The market expects sales growth to decline gradually from 2020. As a result, we would expect the EV/Sales ratio to diminish. Besides, other competitors trade at an average of 6.6x and a median of 5.6x sales. Secondly, the previous company founded by the CEO saw massive enterprise decline after the company’s sales growth diminished. We don’t think that Bilibili will have to suffer the same valuation declines. However, investors need to know about this fact. In the light of these results, we understand the position taken by short sellers on this name.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in BILI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.