Sometimes stocks make irrational runs and investors just need to let them go. In such a scenario, Micron Technology (MU) has already surged above $55 per share despite horrible quarterly results. History had shown that the data storage stock doesn't run until revenue declines reach bottom, but the stock surged this cycle far before the lows. Investors are best off just letting the stock go unless Micron actually sees a meaningful pullback from here.

Image Source: Micron Tech. website

Jumping The Rebound

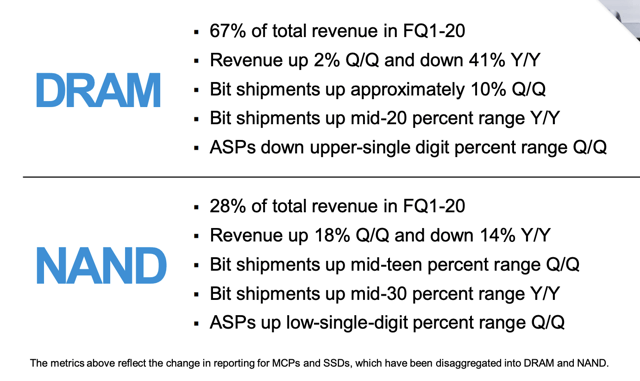

The company isn't even predicting a DRAM or NAND pricing rebound immediately and the guidance of the current quarter isn't exactly that impressive. Micron actually guided below analyst estimates of both numbers for FQ2:

- Revenue of $4.5-4.8 billion below consensus of $4.77 billion

- EPS of $0.29-0.41 below consensus of $0.41

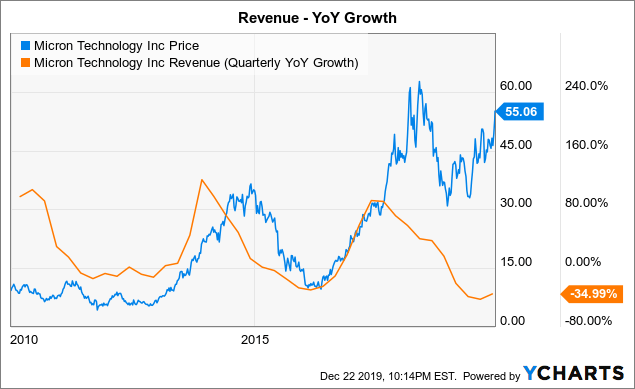

The company does discuss a FQ3 industry recovery, but the real issue is the market jumping ahead of the rebound this cycle. For FQ1, Micron produced a 35% decline in revenues and the guidance for FQ2 has revenues dipping ~20% over last FQ2.

The quarterly YoY revenue decline was actually a slight improvement from last quarter's level of over 42%. The industry trend has already hit bottom, but the issue here is the stock has already blasted higher. In the last few cycles, Micron traded at the lows as the turned occurred.

Data by YCharts

Data by YChartsMicron reached a low below $30 at the end of 2018 and the stock has already topped $55 before the cycle hasn't even technically turned. The ideal time was to buy around $32 back in June, but investors following the philosophy here were looking to squeeze out more profits.

Nothing wrong with letting a stock run and missing out. What investors need to understand now is that Micron isn't far off the decade highs despite forecasting the lowest quarterly EPS in the current quarter for this down cycle.

A big part of the problem is that all-important DRAM pricing still hasn't hit a low. DRAM accounts for nearly 70% of revenues and ASPs still fell nearly 10% QoQ.

Source: Micron FQ1'20 presentation

Source: Micron FQ1'20 presentation

During the FQ1 earnings call, CEO Sanjay Mehrotra wasn't bullish about cycle recovery in the current quarter as industry builds in China and supply-demand balances are still problematic:

"Industry supply demand balance continues to improve in both DRAM and NAND. Recent trends in our business give us optimism that our fiscal second quarter will mark the bottom for our financial performance, which we expect to start improving in our fiscal third quarter, with continued recovery in the second half of calendar 2020.

As we discussed on our last call, a portion of the strength in demand in the second half of calendar 2019 may be attributable to inventory builds in China, and we expect some of this customer inventory to normalize sometime in calendar 2020."

Micron Wasn't Even Bullish

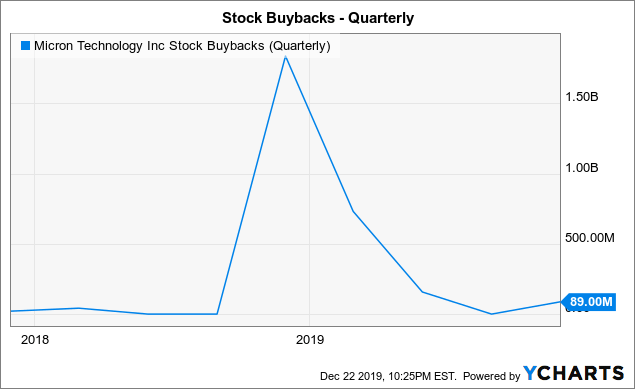

Based on the stock buybacks, even Micron Technology was surprised by the stock rally off the lows before revenues improved. The memory company famously announced a $10 billion buyback plan back in 2018, but the company only spent $1.8 billion on repurchases during FQ4'18 and another $732 million during FQ1'19. In the last quarter, Micron only bought a minimal amount of shares, though the company did spend $200 million on buying up convertible debt to prevent a 3 million share dilution.

Data by YCharts

Data by YChartsThe company had their best cash position of the decade throughout 2019, yet Micron quickly pulled back on stock buybacks. Oddly, CEO Sanjay Mehrotra long claimed a down cycle wasn't gong to occur, but when the company went through a period of over 40% revenue declines, the company didn't aggressively repurchased shares as the stock consistently traded in the $30s.

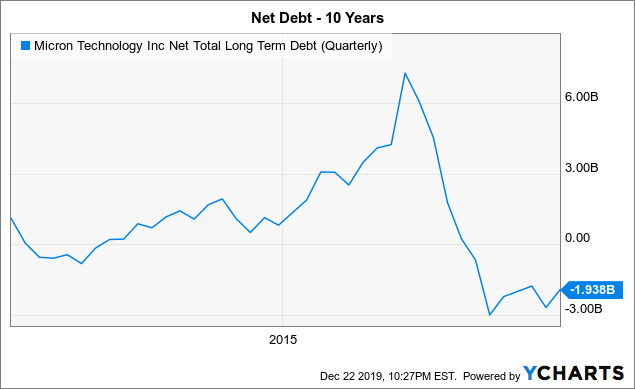

The below chart represents a net cash position via a negative net long-term debt position. Micron spent the majority of the decade with net debt rising to over $6 billion. Of course, the company doesn't want to go back into a large net debt position, but the point of a large share buyback approval was to purchase shares during the down cycle.

Data by YCharts

Data by YChartsMicron is now worth over $60 billion, yet the company only spent $2.8 billion on share buybacks in a period when the stock was beaten down and the company had $10 billion authorized. For FQ1'20, the diluted share count only declined by 45 million or less than 4% from last year.

Takeaway

The key investor takeaway for those that missed this rally is to just let Micron go. If the stock dips back down on the reality of another weak quarter and an industry recovery that won't happened until FQ3, investors can pounce on the stock.

Micron Technology already trades near decade highs and the company is only expected to earn $2.27 per share this year with the stock trading at $55. Analyst estimates continue to decline and the likely outcome of the next year is limited stock gains.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.