The stock market continues to make record highs, but there remain some bargain stocks that investors can choose from, according to CNBC's Jim Cramer.

The basket of picks he presented on Tuesday come from equities analysis offered by Carolyn Boroden of FibonnaciQueen.com. They are primarily software plays that touch the e-commerce, video game and payment landscapes.

"Even in a red-hot market, there are plenty of stocks that could have more room to run, and the charts, as interpreted by Carolyn Boroden, suggest that Shopify, Nvidia and PayPal are all worth owning here, especially if you can get them into weakness," the "Mad Money" host said.

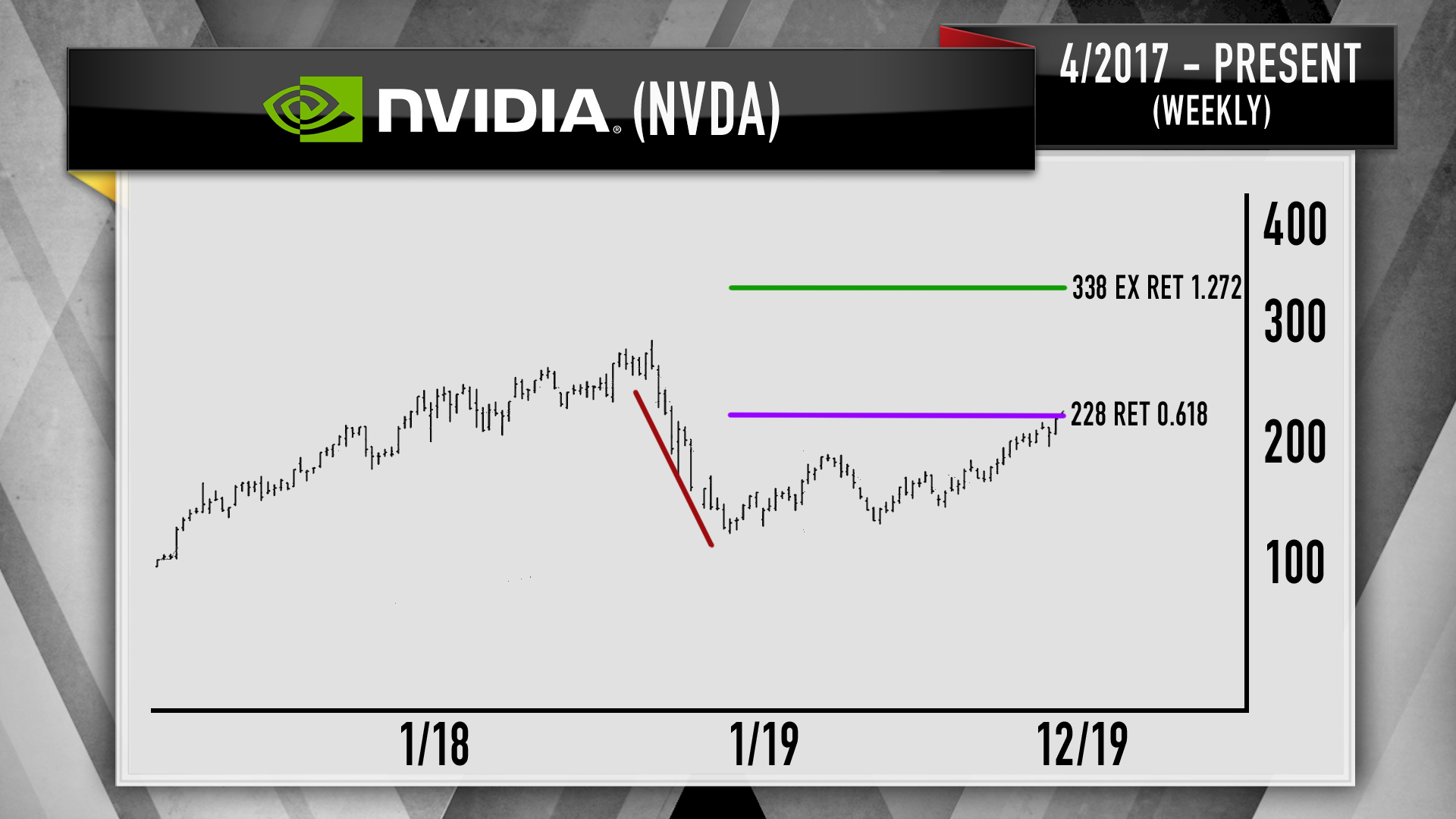

The findings can be explained through each stock's weekly chart action, Cramer pointed out. In Boroden's analysis, she used Fibonacci numbers — mathematical indicators that can help technicians predict market moves — to gauge the odds that the stocks could rebound more than 127% from their bottom.

When a security or market declines 10% or more from a recent peak, it's called a correction. That correction can last days, weeks, months or longer.

"When a bull market experiences a correction but its uptrend remains intact, we almost always see a ... 127.2% Fibonacci extension of the corrective pullback. An extension is what happens when you reverse 100% of a previous swing and then rally some more on top of that," Cramer said. "This is why Boroden loves to use these 127.2% extensions as her initial upside targets when she's setting up a trade."

Shares of Shopify, the cloud-based platform that helps small businesses build online stores, dropped about 30% between late August and early November, bottoming near $282. Since that low point, the stock has moved almost 36% within the past six weeks, according to FactSet.

Shopify is still about 19 points off its peak close. If Boroden's theory holds true, Shopify is headed for $444.30, 15% upside from current levels, Cramer said.

"Ideally, though, Boroden wants to get this [one] at a better price, because if Shopify gets hit again, she thinks it's worth buying into weakness as long as it doesn't fall through its [floor of] support in the $280s," the host said.

In Nvidia's case, the chipmaker is an outlier of its group. Nvidia shares are still more than 20% below their October 2018 high that preceded that year's brutal fourth-quarter sell-off. The stock closed Tuesday's session at $228.29, still roughly $61 below that point.

"If the stock can make the 127.2% retracement extension ... it goes to $338, up 48% from where it's currently trading. That's where Boroden thinks Nvidia is headed," Cramer said, adding that she recommends investors wait for another pullback before buying the stock.

PayPal peaked above $121 in late July, and shares remain in correction territory since bottoming under $97 in October. The stock has about $13 to run before it recovers all those losses. Boroden, Cramer said, thinks it can keep running higher if it doesn't break below about $95.

"Assuming PayPal can hold above its recent lows in the mid-90s," he said, "Boroden believes the uptrend is intact. And if the uptrend's intact … [it's] a 19% gain that we might be able to get" to almost $129.

Cramer warns, however, if any of these stocks fall under their floor of supports, or their recent lows, these bets are off the table.

Disclosure: Cramer's charitable trust owns shares of Nvidia.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com