Image copyright

PA Media

Image copyright

PA Media

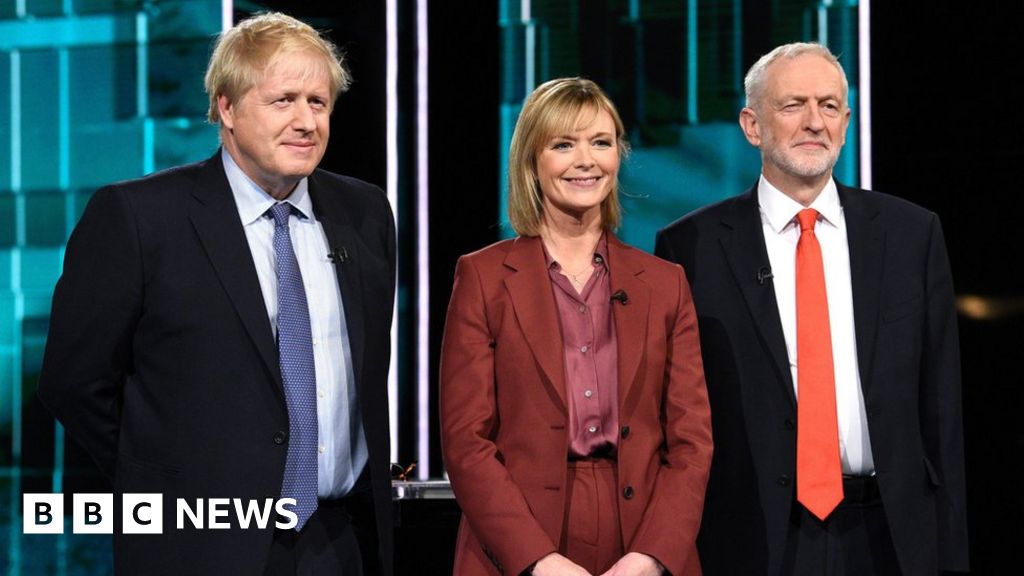

Boris Johnson and Jeremy Corbyn clashed on issues ranging from Brexit to the NHS during the first leaders' debate.

The BBC Reality Check team has analysed some of their claims.

Claim: Jeremy Corbyn said that Boris Johnson's deal "narrowly got through the House of Commons with the support of the DUP".

Reality Check: That's not right - Mr Johnson's deal was supported by 285 Conservative MPs, 19 Labour MPs and 25 independents.

All 10 MPs from Northern Ireland's Democratic Unionist Party (DUP) voted against the deal.

You can find out how any MP voted using this tool.

Please upgrade your browser to view this interactive

Claim: Boris Johnson said the Tories were putting 20,000 more police officers on the streets, as well as upgrading 20 hospitals and building 40 new hospitals

Reality Check: Since 2010, police officer numbers have decreased by 20,500 in England and Wales, so the 20,000 new ones would not quite replace them.

On hospitals, the government has already announced 20 hospitals it plans to upgrade, but is it building 40 new ones?

The government has pledged £2.7bn for building work on six hospitals. A further 34 will only share an initial £0.1bn to develop future plans - rather than start building immediately.

You can read more about the 40 new hospitals in this Reality Check.

Claim: Jeremy Corbyn said there were 33,000 nurse vacancies at the moment in the NHS

Reality Check: The Labour leader made this claim while talking about the state of the health service under the Conservatives. It's a bit of an understatement - there are currently 39,500 nursing vacancies in the NHS in England, according to figures from NHS Improvement.

Claim: Boris Johnson denied his Brexit deal would put a trade border down the Irish sea, saying: "Northern Ireland is part of the customs territory of the UK."

Reality Check: It all depends how you define "a trade border down the Irish Sea" but, under his agreement, there would be checks on goods going from Great Britain (GB) to Northern Ireland (NI).

Under the deal, Northern Ireland will continue to follow many EU rules on food and manufactured goods, while the rest of the UK will not. This will mean checks on, for example, products of animal origin, but the precise details haven't been worked out.

Goods entering NI and deemed at risk of being moved to the Republic of Ireland would also be subject to EU customs tariffs (one trade expert has suggested more than 60% could be affected). The deal would allow firms to claim the tariff back if the goods didn't end up crossing the border.

The Brexit Secretary Stephen Barclay has also said firms exporting goods from NI to GB will need to fill out "exit declarations" but Boris Johnson has denied there would be any checks.

Claim: Jeremy Corbyn said Boris Johnson would "sell our NHS out to the United States and Big Pharma".

Reality Check: This has been one of Labour's attack lines during the election campaign.

The party has claimed that under a post-Brexit trade deal between the UK and the US, under Boris Johnson, the NHS would be "up for sale".

US trade negotiators have set out their objectives for any such trade deal with the UK, including "full market access" for US pharmaceuticals.

The prime minister responded by saying: "There are no circumstances… in which this government or any Conservative will put the NHS on the table in any free trade negotiation."

Claim: Boris Johnson said corporation tax in the UK was "already the lowest in Europe".

Reality Check: He was referring to his decision to postpone a planned cut in UK corporation tax - on companies' profits - from 19% to 17%.

But Ireland, for example, has a rate of 12.5%, according to statistics from the Organisation for Economic Cooperation and Development (OECD).

Claim: Boris Johnson said Labour would "whack it up to the highest in Europe".

Reality Check: Jeremy Corbyn replied that over the course of the next Parliament a Labour government would increase corporation tax to "around the levels it was in 2010". Back then, it was 28%. So, would this be the highest in Europe?

At the moment, several European countries have higher corporation tax rates than this: France 32% and Belgium 29%. Both countries are planning reductions though: France to 28% and Belgium to 25%.